|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Understanding Pet Insurance: A Comprehensive Guide to Getting StartedIn today's world, where pets are cherished members of the family, ensuring their health and well-being becomes paramount. Navigating the realm of pet insurance can seem daunting at first, but with the right approach, it becomes a manageable task. This guide will help you explore the nuances of pet insurance, providing insights into how you can secure the best coverage for your furry companions. Why Consider Pet Insurance? Pets, like humans, are prone to accidents and illnesses, which can lead to significant veterinary expenses. With the rising costs of veterinary care, having a robust insurance plan can offer peace of mind and financial security. By investing in pet insurance, you are not only protecting your pet but also safeguarding your finances. Key Considerations When Choosing Pet InsuranceAs you embark on this journey, several factors should be taken into account. Understanding these elements will aid you in making an informed decision.

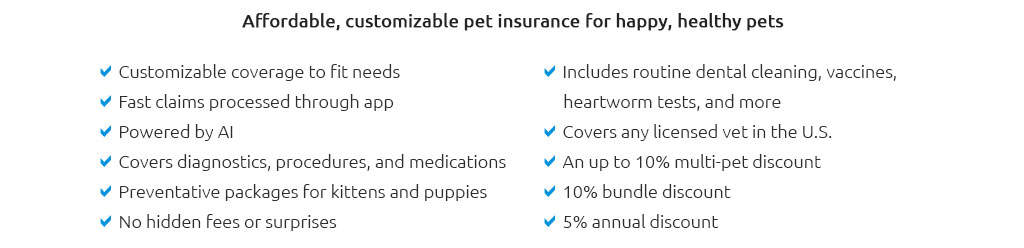

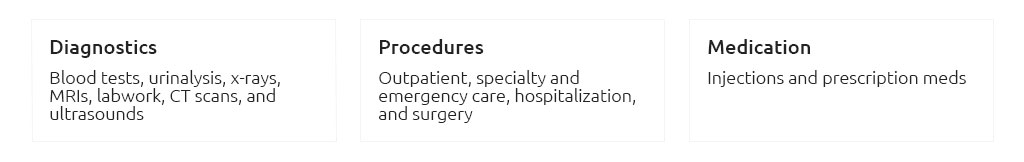

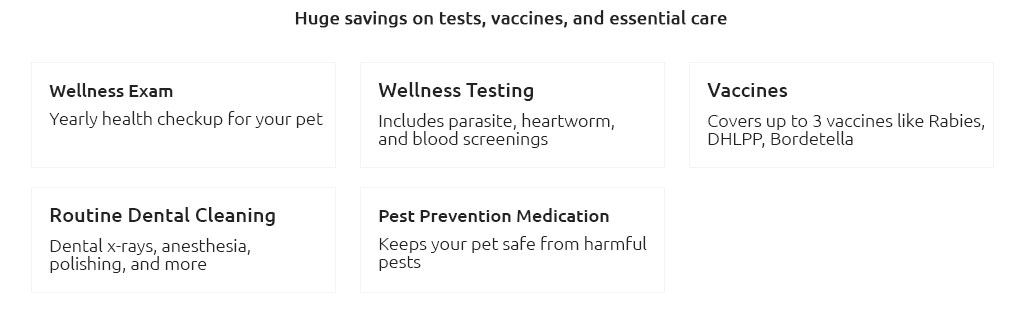

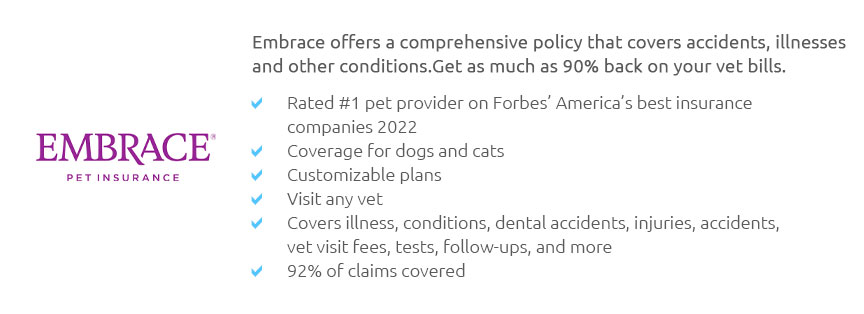

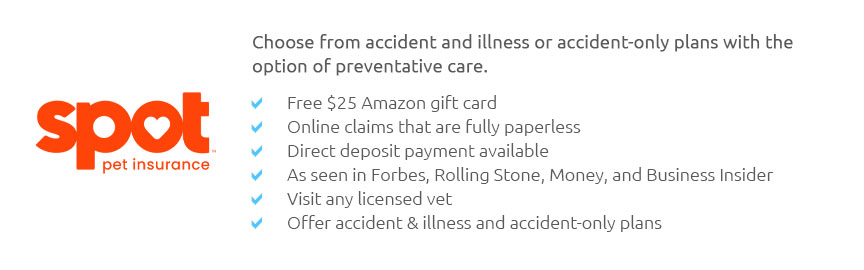

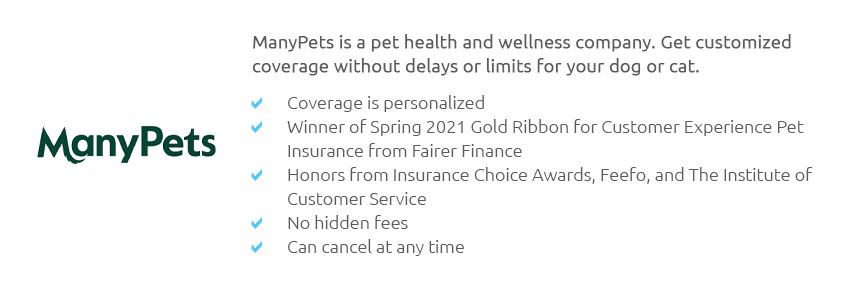

Comparing Popular Pet Insurance ProvidersTo ease the selection process, let's delve into some popular pet insurance providers, comparing their features and offerings.

Making the Right Choice for Your Pet Ultimately, the best pet insurance policy is one that aligns with your pet's specific needs and your financial situation. Whether you prioritize comprehensive coverage, affordability, or a seamless claims process, each provider offers unique benefits. Conduct thorough research, compare plans, and perhaps even consult your veterinarian for recommendations. Remember, investing in pet insurance is not just about managing potential costs; it's a commitment to your pet's long-term health and happiness. With the right policy in place, you can enjoy the companionship of your beloved pet with added peace of mind. https://www.pawlicy.com/blog/what-is-pet-insurance/

Where can you get pet insurance? You can get pet insurance by contacting any pet insurance company directly. The easiest way to get it is to search for a ... https://www.healthypawspetinsurance.com/

Pet insurance for dogs & cats through Healthy Paws covers new accidents, illnesses, emergency care, and more with no limits on claim payouts. Get a free ... https://www.progressive.com/pet-insurance/

How Progressive Pet Insurance plans by Pets Best and Companion Protect compare - One deductible - Fast claims - Get expert help.

|